Introduction

Embarking on a quest to find a reputable offshore broker can often be a daunting task due to the countless choices available.

Among the array of available options, one name that has been a point of discussion is HiveMarkets. In light of this, a comprehensive analysis of their operation becomes pivotal to determine their authenticity and reliability.

This detailed review seeks to shed light on the various aspects of Hive Markets, such as their registration status, trading platform, customer support, and more.

Hive Markets Details

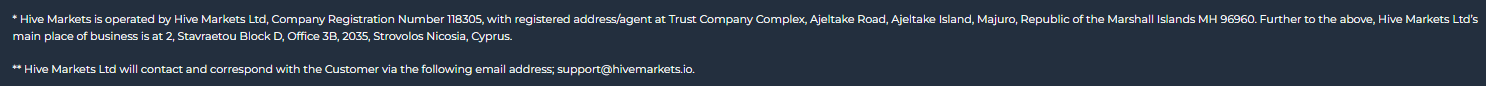

Hive Markets, an online trading brokerage, is a subsidiary of Hive Markets Ltd. The firm’s offices are situated at two different locations: Trust Company Complex on Ajeltake Road, Ajeltake Island, Majuro, in the Republic of the Marshall Islands MH 96960, and 2, Stavraetou Block D, Office 3B, 2035, Strovolos Nicosia, Cyprus.

For assistance or inquiries, Hive Markets’ support team can be contacted via email at support@hivemarkets.io.

Their official website is hivemarkets.io.

It’s of utmost importance to exercise diligence and undertake thorough research before deciding to use any online trading platform, Hive Markets included.

To help you make an educated decision, consider checking out our in-depth reviews of two other companies we have recently examined: CitizenCryptoMiningFX and SFCmarket.

Hive Markets: Insights into its Registration and Regulation Status

Professing to be based out of Cyprus, Hive Markets is an offshore broker that has been subject to significant speculation.

This information in itself rings alarm bells as they do not hold a license from the Cyprus Securities and Exchange Commission (CySEC), a critical point that we shall delve into shortly.

The Registration Paradox

For any brokerage firm, maintaining transparency about their registration and licensing status is paramount. A disconnect between the firm’s claim and the actuality can lead to an erosion of trust.

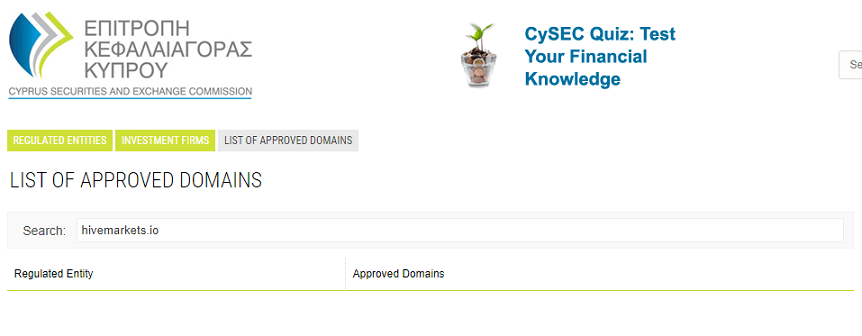

HiveMarkets states that their primary place of business is Cyprus, which would naturally lead any potential client to assume that they are regulated by the CySEC.

However, they do not hold such a license, creating a dichotomy between their claims and reality. This ambiguity might mislead prospective traders into thinking Hive Markets is licensed by CySEC, which is not the case.

We decided to verify Hivemarkets.io on the CySEC register, but we did not find it listed as a CySEC approved domain.

The Offshore Conundrum

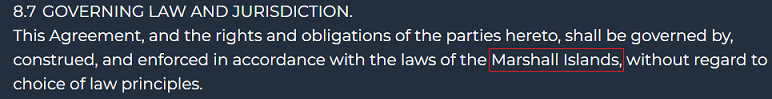

HiveMarkets’ primary operational base has often been a topic of discussion, with speculation centering on Cyprus and the Marshall Islands. To ascertain the truth, we delved into the platform’s terms and conditions. As evidenced by the accompanying screenshot, the jurisdiction default for HiveMarkets is, indeed, the Marshall Islands.

Further adding to the complexities, Hive Markets is registered in the Marshall Islands, a known offshore jurisdiction. This offshore location is another layer that deepens the potential risk for traders and investors.

Offshore brokerage firms, due to their locations, often fall beyond the jurisdiction and regulations of mainstream financial bodies. This absence of stringent regulation poses a substantial risk to traders in terms of fund security.

Marshall Islands does not have a specific regulatory body dedicated to overseeing and regulating Forex (foreign exchange) companies. The country is known to be an offshore jurisdiction, and its financial services sector operates under the Marshall Islands Business Corporations Act.

However, this legislation primarily focuses on the formation and regulation of companies, rather than the oversight of financial activities, including forex trading.

Due to the lack of a dedicated regulatory authority for forex companies in the Marshall Islands, many forex brokers choose to register their businesses in this jurisdiction to take advantage of its lenient regulatory environment.

However, this also means that investors and traders should exercise caution when dealing with forex brokers based in the Marshall Islands, as they may not have the same level of oversight and protection as brokers regulated by more reputable financial authorities in other countries.

The Trading Landscape at HiveMarkets

Platform Dynamics

Trading platforms serve as the central hub of any broker’s operations, facilitating crucial trading activities.

Hive Markets utilizes the renowned MT4 Platform, a staple in the trading industry, and their TradeLocker Trading Platform.

Both platforms, equipped with advanced charting capabilities and an assortment of technical indicators, stand testament to Hive Markets’ commitment to providing comprehensive trading solutions.

Account Variants and Trading Conditions

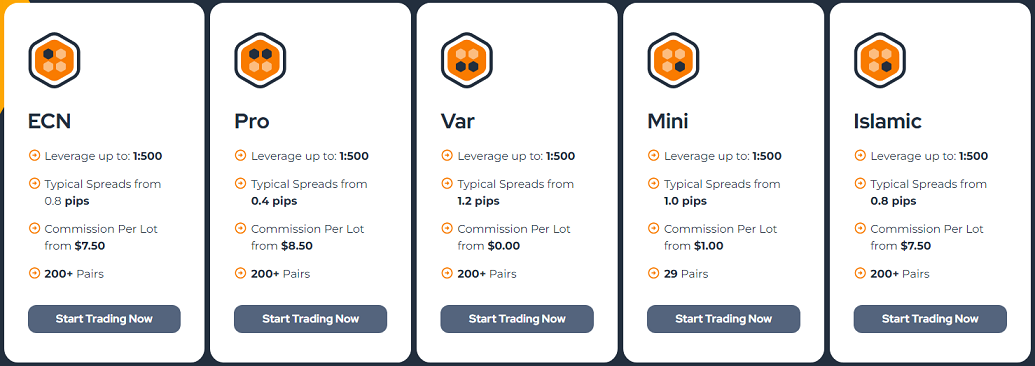

The flexibility to choose from various account types is a feature that traders often look for, and Hive Markets seems to deliver on this front. They offer multiple account types. The available account types include:

Hive Markets offers the ability to customize your investment portfolio via two account types: ECN or Islamic. To further cater to diverse trading needs, they present different trading options like Standard, Var, Pro, and Mini, each with unique spreads and commission levels.

A Demo Account is available for risk-free practice. However, Hive Markets does not provide clear information regarding the minimum deposit for each account type.

Conclusion

To summarize, Hive Markets offers a range of features that could potentially cater to various trader requirements. Their trading platform and a diverse set of account options are noteworthy aspects of their service. However, the ambiguity surrounding their licensing status creates a cause for concern. Hive Markets’ claim of being Cyprus-based, without being licensed by CySEC, might lead to potential misunderstandings among traders. Thus, it becomes imperative for traders to proceed with caution, thoroughly checking the credentials and licensing status of any broker before investing their hard-earned money.

Got Scammed by Hive Markets?

If you have lost money with Hive Markets, stay calm. It has likely happened to many others, and it its important to learn from these experiences. Do not forget that even the most cautious investors can fall victim to online fraud.

The good news is that there is help available. The team at MyChargeBack – a specialist group dedicated to helping consumers recover funds lost online – can help you.

5 Simple Steps To Get A Chargeback From Hive Markets

Follow our straightforward guide to efficiently reclaim your lost funds from Hive Markets with minimal hassle.

- Complete the Form: Begin by completing the form above, providing necessary details about your case. This allows the team to understand your situation with Hive Markets and prepare for the consultation.

- Get A Free Consultation: Schedule a free consultation with MyChargeBack team of experts. During this consultation, they will assess your case and offer guidance on the best course of action to recover your lost funds from Hive Markets.

- In-Depth Case Analysis: As you proceed with MyChargeBack, their expert team conducts an in-depth analysis of your case, identifying the optimal chargeback strategy for fund recovery based on your unique circumstances.

- Recovery Process: Their team of specialists scrutinizes your case, collects evidence, and negotiates with the involved parties to expedite the recovery of your funds. MyChargeBack team will consistently communicate with you and your bank or card issuer during the chargeback process.

- Fee Payment: Upon successful recovery of your funds lost to Hive Markets, MyChargeBack charges a fee as a percentage of the reclaimed amount. If fund recovery is unsuccessful, no fees apply, except in exceptionally complex cases.

Through these five straightforward steps, MyChargeBack simplifies the fund recovery process, enabling you to reclaim your money from Hive Markets with minimal inconvenience.

FAQs

Is Hive Markets licensed by the CySEC?

No, despite stating that they are based in Cyprus, Hive Markets does not hold a license from the CySEC.

What type of trading platform does Hive Markets offer?

Hive Markets operates on the renowned MT4 Platform and TradeLocker Beta, which is equipped with essential charting tools and various technical indicators.

How many account types does Hive Markets provide?

Hive Markets offers a range of account types, each catering to different trading requirements and conditions.

Do trading conditions remain the same across all account types?

No, the trading conditions can significantly vary between different account types.

Is Hive Markets a safe choice for investing?

Considering that Hive Markets does not hold a CySEC license despite claiming to be based in Cyprus, potential investors are advised to tread cautiously and conduct thorough research before investing.