Introduction

Online trading can be a great way to make money, but it’s also full of risks, especially when the trading platform you’re using is not on the up-and-up. Guardian Invest is a platform that has been raising eyebrows for all the wrong reasons.

This review will break down why you might want to think twice before investing your money with this unregulated broker.

Guardian Invest Details

GuardianInvest operates as an online trading broker but maintains a cloak of anonymity.

For inquiries or support, you can contact their team via email at compliance@guardianinvest.co.

The broker’s website is accessible at guardianinvest.co.

Given the anonymity of this platform, it is crucial to proceed with caution and undertake thorough research prior to any engagement with GuardianInvest or similar online trading platforms.

To help you make an educated decision, consider checking out our in-depth reviews of two other companies we have recently examined: FUTU Pro / FutuBit and Gemini2 (openaiprotect.com).

The Faceless Entity Behind GuardianInvest

Who Owns the Platform?

The identity of the entity behind GuardianInvest.co is a puzzle with missing pieces. No company name, registration number, or key personnel are disclosed, leading to an opaque operating environment that raises more questions than it answers.

An anonymous trading platform is usually a red flag for potential investors.

Where Does GuardianInvest Operate From?

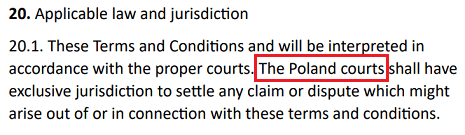

Guardian Invest is cryptic about its operational jurisdiction. While the platform itself does not explicitly state its location, a careful read of their Terms and Conditions reveals that the governing law for the platform is Poland.

Notably, GuardianInvest does not hold a license from the Polish Financial Supervision Authority (KNF), the regulatory body for financial services in Poland.

This discrepancy not only muddies the waters but also seriously puts the legality of their operations into question

Multiple Regulatory Warnings

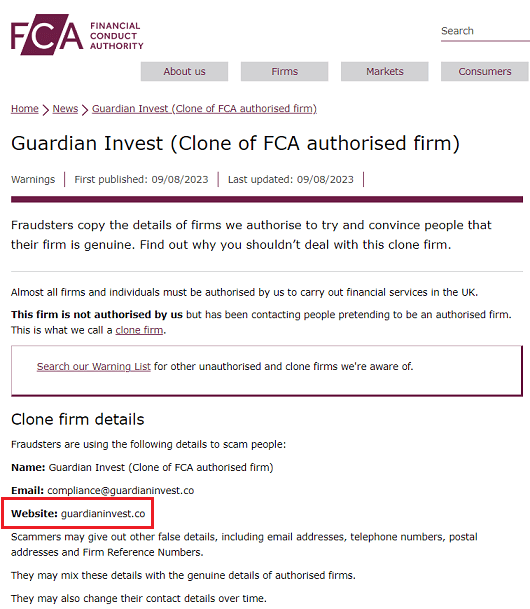

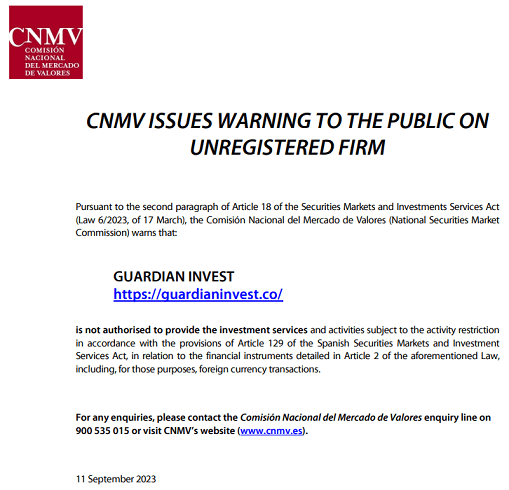

Further complicating GuardianInvest’s already suspect reputation are warnings from three major financial regulatory bodies.

The Financial Conduct Authority (FCA) in the United Kingdom, The Financial Supervisory Authority (FSA) in Romania, and the Comisión Nacional del Mercado de Valores (CNMV) in Spain have all issued warnings against this platform.

Regulatory warnings are usually the strongest signs to potential investors to steer clear of a trading platform.

Engaging with an unregulated broker like GuardianInvest is fraught with risks. When a broker isn’t regulated, it means they are not subject to any oversight by a governing body.

This lack of accountability means that the broker can operate however they please, often leading to fraudulent practices. Clients are at high risk of losing their invested capital without any safety nets.

Additionally, unregulated brokers often offer no protection or recourse for clients in the event of misconduct. Thus, ignoring regulatory warnings and choosing to invest with an unregulated entity like GuardianInvest can result in devastating financial loss.

Risky Software Practices

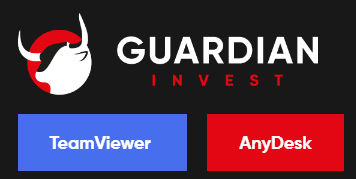

The utilization of remote desktop software such as AnyDesk or TeamViewer by GuardianInvest raises significant concerns about the integrity and safety of the platform. Remote desktop software allows for third-party control over a computer, typically for the purposes of troubleshooting or customer support.

However, in the context of a trading platform that lacks regulatory oversight, this opens a Pandora’s box of potential vulnerabilities. There have been numerous cases where such software was exploited to gain unauthorized access to a user’s computer within the realm of forex trading platforms.

Once access is obtained, malevolent actors can manipulate trading interfaces, deplete funds from trading accounts, or, in more severe cases, harvest sensitive financial and personal data such as banking credentials, credit card information, and stored passwords. Such activities expose clients to an elevated risk of financial and identity theft.

Trading Assets and Account Types

Range of Trading Assets

Guardian Invest provides an array of trading assets via its web-trader apps:

- Forex

- Commodities

- Indices

- Stocks

Types of Accounts

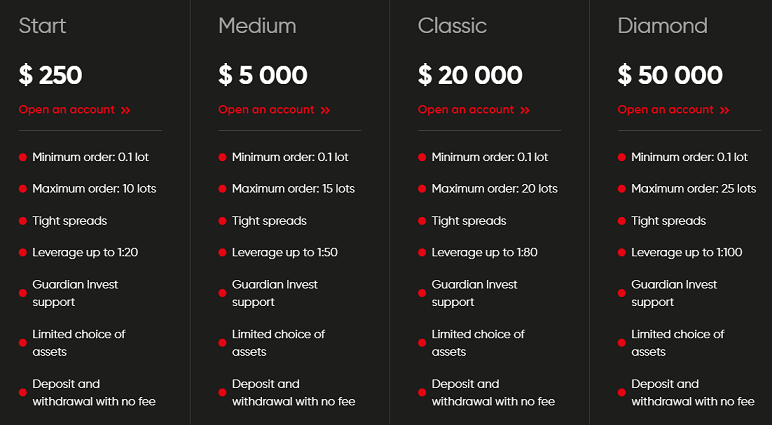

GuardianInvest offers four types of trading accounts, each with their own set of terms:

- Start: Minimum deposit of $250 and leverage up to 1:20.

- Medium: Minimum deposit of $5,000 and leverage up to 1:50.

- Classic: Minimum deposit of $20,000 and leverage up to 1:80.

- Diamond: Minimum deposit of $50,000 and leverage up to 1:100.

Conclusion

Guardian Invest may offer a range of assets and account types, but these features are overshadowed by its glaring issues—anonymous ownership, ambiguous operational jurisdiction, multiple regulatory warnings, and risky software practices. Investing in this platform poses significant risks, and caution is highly advised.

Got Scammed by GuardianInvest?

If you have lost money with GuardianInvest, stay calm. It has likely happened to many others, and it its important to learn from these experiences. Do not forget that even the most cautious investors can fall victim to online fraud.

The good news is that there is help available. The team at MyChargeBack – a specialist group dedicated to helping consumers recover funds lost online – can help you.

5 Simple Steps To Get A Chargeback From GuardianInvest

Follow our straightforward guide to efficiently reclaim your lost funds from GuardianInvest with minimal hassle.

- Complete the Form: Begin by completing the form above, providing necessary details about your case. This allows the team to understand your situation with GuardianInvest and prepare for the consultation.

- Get A Free Consultation: Schedule a free consultation with MyChargeBack team of experts. During this consultation, they will assess your case and offer guidance on the best course of action to recover your lost funds from GuardianInvest.

- In-Depth Case Analysis: As you proceed with MyChargeBack, their expert team conducts an in-depth analysis of your case, identifying the optimal chargeback strategy for fund recovery based on your unique circumstances.

- Recovery Process: Their team of specialists scrutinizes your case, collects evidence, and negotiates with the involved parties to expedite the recovery of your funds. MyChargeBack team will consistently communicate with you and your bank or card issuer during the chargeback process.

- Fee Payment: Upon successful recovery of your funds lost to GuardianInvest, MyChargeBack charges a fee as a percentage of the reclaimed amount. If fund recovery is unsuccessful, no fees apply, except in exceptionally complex cases.

Through these five straightforward steps, MyChargeBack simplifies the fund recovery process, enabling you to reclaim your money from GuardianInvest with minimal inconvenience.

FAQs

Is GuardianInvest a regulated broker?

No, GuardianInvest has not been regulated by any reputable financial authority.

Who owns GuardianInvest?

The ownership of GuardianInvest is not disclosed, making it an anonymous trading platform.

What trading assets does GuardianInvest offer?

You can trade Forex, commodities, indices, and stocks.

Is it risky to use the software GuardianInvest recommends?

Yes, the use of remote desktop software like AnyDesk and TeamViewer can put your personal data at risk.

Have any financial regulators issued warnings against GuardianInvest?

Yes, the FCA, FSA, and CNMV have all issued warnings against this platform.