Introduction

Choosing the right broker is paramount for a successful and secure trading experience. Among the numerous brokers available, FIVORO has emerged as a notable name.

This review aims to provide an in-depth analysis of FIVORO, an unregulated offshore broker, shedding light on its claims, operations, and the potential risks associated with it.

Stay In Touch With FIVORO

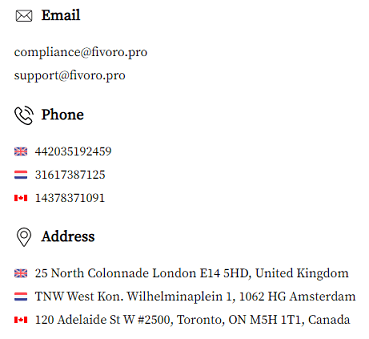

Fivoro, an online trading platform, property of Urvashi Limited. The firm has offices in Saint Vincent and the Grenadines, 25 North Colonnade, London E14 5HD, UK, TNW West Kon. Wilhelminaplein 1, 1062 HG Amsterdam, Netherlands, and 120 Adelaide St W #2500, Toronto, ON M5H 1T1, Canada.

For inquiries or support, Fivoro can be contacted via phone at numbers including +442031399073, +31102005256, +442081570407, and others. Alternatively, they can be reached via email at addresses such as compliance@fivoro.com and support@fivoro.pro.

Their online platforms include websites like fivoro.com, fivoro.io, fivoro.pro, and fivoro.capital.

Engaging with any online trading platform requires careful consideration. It’s crucial to approach Fivoro with due diligence and thorough research.

To help you make an educated decision, consider checking out our in-depth reviews of two other companies we have recently examined: 500Markets and SwissIAM.

Company Background and Regulatory Status

FIVORO’s Claims

FIVORO claims to operate under the umbrella of Urvashi Limited, a company registered in Saint Vincent and the Grenadines.

This Caribbean island nation is often associated with a lack of stringent financial regulations.

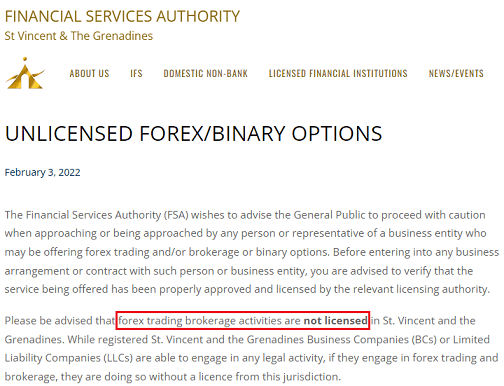

In fact, the Financial Services Authority (SVGFSA) of Saint Vincent and the Grenadines has explicitly stated that they do not oversee forex activities.

This means companies registered in this territory can operate without any regulatory oversight.

International Presence and Regulatory Warnings

Further, FIVORO asserts to have offices in the United Kingdom, Netherlands, and Canada. However, these claims raise eyebrows.

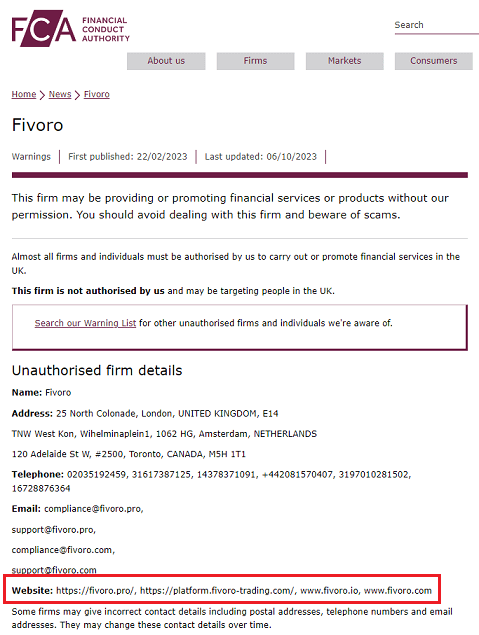

The Financial Conduct Authority (FCA), a renowned financial regulator in the United Kingdom, has issued a warning against FIVORO.

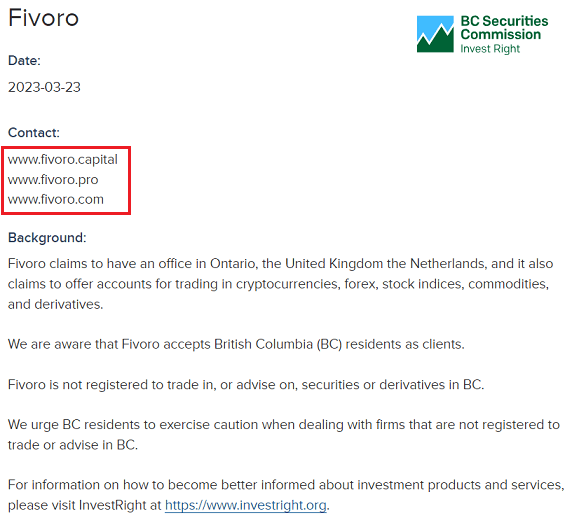

Similarly, two Canadian regulatory bodies, the Alberta Securities Commission (ASC) and the British Columbia Securities Commission (BCSC), have also flagged FIVORO.

The Financial Supervisory Authority (FSA) from Romania has joined the chorus of warnings. Given these red flags, it’s highly improbable that FIVORO operates legitimately from these countries.

Domain Dodging

Interestingly, post these regulatory warnings, FIVORO has been seen changing its domain name multiple times, transitioning from fivoro.com to fivoro.pro, then to fivoro.capital, and currently residing at fivoro.io.

Such moves often indicate an attempt to evade negative attention and continue operations unnoticed.

The Importance of Choosing a Regulated Broker

Risks of Trading with Unregulated Brokers

Choosing a regulated broker is not just a matter of preference; it’s a matter of security. Regulated brokers are bound by strict guidelines and are accountable to regulatory bodies.

This ensures transparency, fairness, and protection of traders’ funds. On the other hand, unregulated brokers, like FIVORO, operate without such oversight. This can lead to:

- Unfair Practices: Manipulation of trading conditions, hidden fees, and sudden platform malfunctions.

- Fund Security: No guarantee of fund safety. Traders might face difficulties in withdrawing their money.

- Lack of Recourse: In case of disputes, traders have limited to no avenues for redressal.

Reputation Matters

Before entrusting your money to any broker, it’s always prudent to check their reputation.

A quick glance at TrustPilot reveals numerous users claiming to have been scammed by FIVORO.

Such feedback from actual users can be a telling sign of the broker’s credibility and operations.

Trading with FIVORO

Available Assets

FIVORO offers a diverse range of assets for trading:

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

Account Types

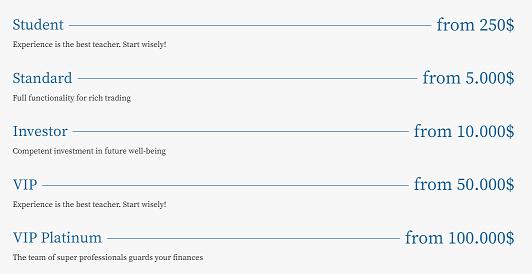

FIVORO provides five distinct account types, catering to different trading needs:

- Student: Minimum deposit $250

- Standard: Minimum deposit $5,000

- Investor: Minimum deposit $10,000

- VIP: Minimum deposit $50,000

- VIP Platinum: Minimum deposit $100,000

Conclusion

While FIVORO offers a variety of assets and account types, the concerns surrounding its regulatory status and the numerous warnings against it cannot be ignored.

Traders must exercise caution and conduct thorough research before making any investment decisions. It’s always better to prioritize safety over potential profits.

Got Scammed by Fivoro?

If you have lost money with Fivoro, stay calm. It has likely happened to many others, and it its important to learn from these experiences. Do not forget that even the most cautious investors can fall victim to online fraud.

The good news is that there is help available. The team at MyChargeBack – a specialist group dedicated to helping consumers recover funds lost online – can help you.

5 Simple Steps To Get A Chargeback From Fivoro

Follow our straightforward guide to efficiently reclaim your lost funds from Fivoro with minimal hassle.

- Complete the Form: Begin by completing the form above, providing necessary details about your case. This allows the team to understand your situation with Fivoro and prepare for the consultation.

- Get A Free Consultation: Schedule a free consultation with MyChargeBack team of experts. During this consultation, they will assess your case and offer guidance on the best course of action to recover your lost funds from Fivoro.

- In-Depth Case Analysis: As you proceed with MyChargeBack, their expert team conducts an in-depth analysis of your case, identifying the optimal chargeback strategy for fund recovery based on your unique circumstances.

- Recovery Process: Their team of specialists scrutinizes your case, collects evidence, and negotiates with the involved parties to expedite the recovery of your funds. MyChargeBack team will consistently communicate with you and your bank or card issuer during the chargeback process.

- Fee Payment: Upon successful recovery of your funds lost to Fivoro, MyChargeBack charges a fee as a percentage of the reclaimed amount. If fund recovery is unsuccessful, no fees apply, except in exceptionally complex cases.

Through these five straightforward steps, MyChargeBack simplifies the fund recovery process, enabling you to reclaim your money from Fivoro with minimal inconvenience.

FAQs

Is FIVORO a regulated broker?

No, FIVORO is an unregulated offshore broker.

Has FIVORO received any warnings from financial regulators?

Yes, FIVORO has received warnings from the FCA in the UK, ASC and BCSC in Canada, and FSA in Romania.

Why is it essential to choose a regulated broker?

Regulated brokers offer transparency, fairness, and protection of traders’ funds, ensuring a secure trading environment.

Why did FIVORO change its domain name multiple times?

While the exact reasons are speculative, such moves often indicate an attempt to dodge regulatory scrutiny and negative feedback.

How many account types does FIVORO offer?

FIVORO provides five account types: Student, Standard, Investor, VIP, and VIP Platinum.

KEN-RENE`LUNDING says:

I WOULD LIKE TO WITHDRAWL THE 200 EURO,FROM MY ACCOUNT,KENRENELUNDING5@GMAIL.COM.

I DID TRY BUT WITHOUT SUCCES.

John Carney says:

I have been ripped off by these guys, as soon as one requests a withdrawal the excuses start pouring out (no money though) and even suggesting one should invest more when they are pretty sure that you’re not going to pay in any more money they just refuse to answer and messages (on WhatsApp) indeed they don’t take, or acknowledge your messages. I am a 74-year-old man, though, in fairness, that shouldn’t matter, but no one is safe from these scoundrels. They, all of them, need to be stopped and need to be dealt with by the law.

Sean Drumm says:

Scammed by Fivoro

Daniel Henriques Costa says:

Ciao aspetto il vostro aiuto il prima possibile grazie