Introduction

Investing your hard-earned money in trading markets is a decision that shouldn’t be taken lightly. One critical factor to consider is the credibility and reliability of your chosen broker.

In this comprehensive review, we dissect Afex EU—a trading platform that, upon initial inspection, may seem to offer a rich range of features but is, in reality, fraught with inconsistencies and red flags.

Our aim is to provide you with sufficient information to protect you from falling prey to such potential scams.

AfexEU Details

Afex EU claims to be an online trading broker, but is not affiliated with the legitimate AFEX Europe Limited. The company purports to be based in Dublin, Ireland.

To get in touch with Afex EU, you can call their support team at +447448362990 or send an email to bianca.spinello@afexeu.com or jessica.bennet@afexeu.com.

Their website is listed as afexeu.com.

Due to the nature of their misrepresented identity, it’s particularly important to be cautious and conduct comprehensive research before engaging with this or any other online trading platform.

To help you make an educated decision, consider checking out our in-depth reviews of two other companies we have recently examined: Cryptos-Wallet and Oxygen-Trade.company.

False Regulatory Claims

One of the most glaring issues with AfexEU is its deceptive assertion that it is regulated by multiple financial authorities, including The Cyprus Securities and Exchange Commission (CySEC), The Bundesanstalt für Finanzdienstleistungsaufsicht (BaFIN), and The Commissione Nazionale per le Società e la Borsa (CONSOB).

These claims lend the platform an air of legitimacy, which is precisely what the company is aiming for. However, upon deeper scrutiny, a more unsettling truth emerges.

When a brokerage claims to be regulated by esteemed financial bodies, it gains a sheen of credibility that can attract traders looking for a safe and transparent environment.

But, when such a claim is found to be false, the consequences can be severe and multifold.

A company willing to lie about something as fundamental as regulatory compliance is likely to be dishonest about other aspects of its service.

This could range from hidden fees and charges to misleading investment advice. All these factors make it extremely risky for any investor to consider using Afex EU for their trading needs

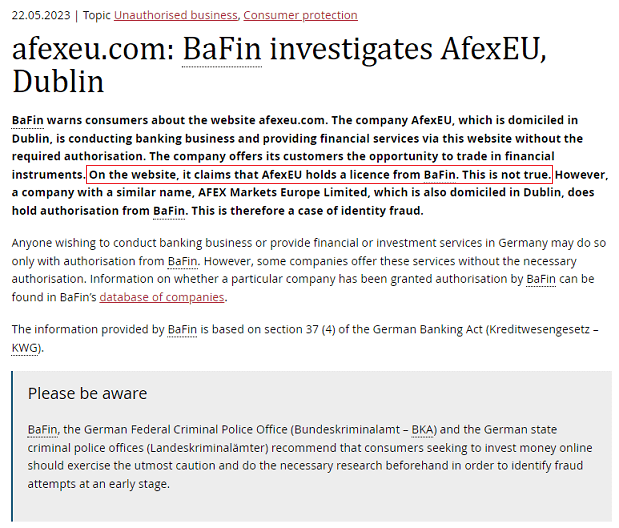

What Regulators Say

Not one, but four regulatory bodies have issued warnings against AfexEU.

These include the Financial Conduct Authority (FCA), Comisión Nacional del Mercado de Valores (CNMV), Central Bank of Ireland (CBI), and the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFIN).

These warnings make it abundantly clear that AfexEU is not authorized to operate within their jurisdictions, contradicting AfexEU’s claims of being a regulated broker.

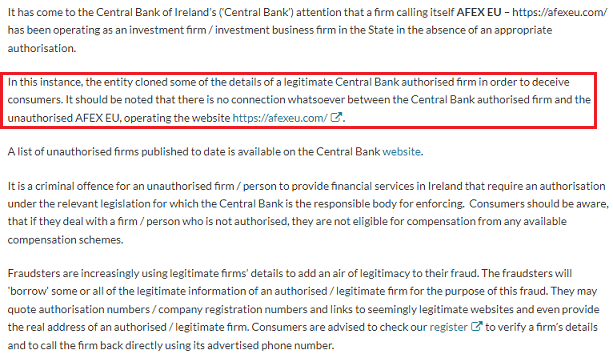

Central Bank of Ireland’s Warning

AfexEU purports to be located in Dublin, Ireland. However, this is yet another fabricating claim designed to mislead potential investors.

The Central Bank of Ireland has issued a stark warning against AfexEU, stating that the platform has cloned details from a legitimately authorized firm to deceive consumers.

The Bank emphasized that there is no connection whatsoever between the authorized firm and AfexEU.

Missing Terms and Conditions

When evaluating a brokerage, the clarity of its terms and conditions is a crucial consideration. This is an area where AfexEU significantly falls short.

A glaring absence of terms and conditions on AfexEU’s platform is alarming, to say the least. Information regarding withdrawal processes, dispute resolution mechanisms, and tax obligations are nowhere to be found.

These are fundamental elements that any legitimate financial services provider should openly disclose to their clients.

From a legal perspective, terms and conditions serve as a binding contract between the brokerage and the client. They define the responsibilities and obligations of each party.

Without these terms, there is essentially no legal framework governing the relationship. This absence can actually make the platform’s operations illegal in many jurisdictions that require financial entities to provide such terms as a part of consumer protection laws.

Such omissions are unacceptable for any brokerage claiming to be legitimate and leave clients vulnerable to an array of risks.

Asset and Account Types

Despite its other failings, AfexEU offers a diverse range of assets and multiple account types.

Though these features may seem appealing, they are ultimately inconsequential given the platform’s other glaring issues.

Range of Assets

- Forex: Currency trading options.

- Cryptocurrency: Digital assets like Bitcoin and Ethereum.

- Commodities: Resources such as gold and oil.

- Indices: Market indexes like the S&P 500.

- Energies: Renewable and non-renewable energy assets.

- Metals: Precious metals like gold and silver.

- Stocks: Shares in various companies.

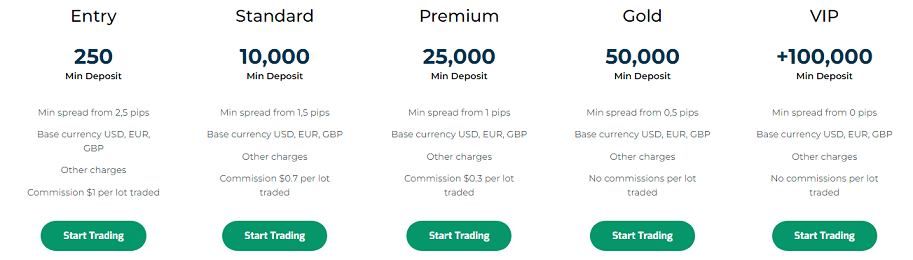

Account Types

- Entry: Minimum deposit $250, Min spread from 2.5 pips

- Standard: Minimum deposit $10,000, Min spread from 1.5 pips

- Premium: Minimum deposit $25,000, Min spread from 1 pip

- Gold: Minimum deposit $50,000, Min spread from 0.5 pips

- VIP: Minimum deposit $100,000, Min spread from 0 pips

Conclusion

While AfexEU may project an image of being a comprehensive trading platform, the lack of regulatory approval and multiple warnings from reputable financial institutions make it a high-risk choice for investors.

The absence of clear terms and conditions further compounds these risks. Therefore, it is strongly advised to steer clear of this platform in favor of regulated and transparent brokerages.

Got Scammed by Afex EU?

If you have lost money with Afex EU, stay calm. It has likely happened to many others, and it its important to learn from these experiences. Do not forget that even the most cautious investors can fall victim to online fraud.

The good news is that there is help available. The team at MyChargeBack – a specialist group dedicated to helping consumers recover funds lost online – can help you.

5 Simple Steps To Get A Chargeback From Afex EU

Follow our straightforward guide to efficiently reclaim your lost funds from Afex EU with minimal hassle.

- Complete the Form: Begin by completing the form above, providing necessary details about your case. This allows the team to understand your situation with Afex EU and prepare for the consultation.

- Get A Free Consultation: Schedule a free consultation with MyChargeBack team of experts. During this consultation, they will assess your case and offer guidance on the best course of action to recover your lost funds from Afex EU.

- In-Depth Case Analysis: As you proceed with MyChargeBack, their expert team conducts an in-depth analysis of your case, identifying the optimal chargeback strategy for fund recovery based on your unique circumstances.

- Recovery Process: Their team of specialists scrutinizes your case, collects evidence, and negotiates with the involved parties to expedite the recovery of your funds. MyChargeBack team will consistently communicate with you and your bank or card issuer during the chargeback process.

- Fee Payment: Upon successful recovery of your funds lost to Afex EU, MyChargeBack charges a fee as a percentage of the reclaimed amount. If fund recovery is unsuccessful, no fees apply, except in exceptionally complex cases.

Through these five straightforward steps, MyChargeBack simplifies the fund recovery process, enabling you to reclaim your money from Afex EU with minimal inconvenience.

FAQs

Is AfexEU a regulated broker?

No, AfexEU is not regulated by any recognized financial authority, contrary to their false claims.

What assets can I trade on AfexEU?

The platform offers a range of assets including Forex, cryptocurrencies, commodities, indices, energies, metals, and stocks.

What are the account types available on AfexEU?

AfexEU offers five account types: Entry, Standard, Premium, Gold, and VIP, each with varying minimum deposits and spreads.

Is it safe to invest with AfexEU?

Given the warnings from multiple financial regulatory bodies, including the FCA, CNMV, CBI, and BaFIN, investing with AfexEU is considered to be high-risk.

What is the minimum deposit for an entry-level account on AfexEU?

The minimum deposit required to open an entry-level account is $250, but given the risks involved, caution is advised.

Marco gauvin says:

Do not trust afex eu dame good scamer i find myself stupide toget couche by those …….. 1000 of cash am 3000 in trades