Introduction

Navigating the vast sea of investment opportunities has never been more challenging. The promise of high returns can lead investors to seemingly attractive shores, but some of these shores are nothing more than mirages.

This is an in-depth look into one such entity – Edu-pension, an unregulated investment company that has raised eyebrows and concerns among the investment community.

Edu-Pension Details

Edu-Pension is an online investment platform operated by MyPension Ltd. The company claims to have offices located at 33 Cavendish Square, W1G 0DT, London, United Kingdom, as well as One Queen Street East, Suite 4000, Toronto, ON M5C 2W5, Canada.

For inquiries or assistance, you can reach Edu-pension’s support team by phone at +442080683946 or +16042436163. Alternatively, they can be contacted via email at support@ForexBusiness.biz or edupensionmanagement@gmail.com.

Visit their official website at edu-pension.com.

Before making any commitment to an online trading or investment platform, including Edu-pension, it’s imperative to approach with caution and undertake thorough due diligence.

To help you make an educated decision, consider checking out our in-depth reviews of two other companies we have recently examined: Crypto 300 Club and Abakus Group SA.

Scratching Beneath the Surface: Unraveling Edu-pension

Regulatory Ambiguity and False Locational Claims

Edu-pension proudly boasts its operations in both the United Kingdom and Canada. However, there’s a stark disconnect between their proclamations and the reality on the ground.

Neither the Financial Conduct Authority (FCA) in the UK nor the British Columbia Securities Commission (BCSC) in Canada has recognized or regulated Edu-pension. This lack of oversight not only casts a shadow of doubt over their legitimacy but also makes potential investors vulnerable to financial malpractices.

Staggering Return Promises: A Fantasy Mirage?

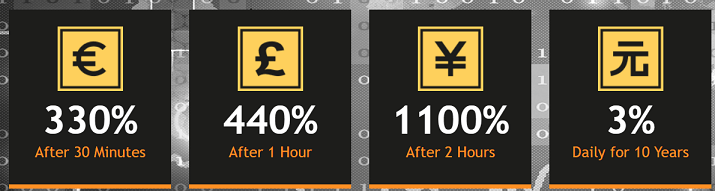

Investment, in its true essence, is about building wealth steadily over time, not an overnight affair. The promises that Edu-pension proffers to its potential investors are not only staggering but defy basic financial logic. They claim returns as high as 330% in just 30 minutes and a jaw-dropping 1100% in a mere 2 hours. This begs the question: How is this even possible?

- Comparative Analysis: When we juxtapose such figures against renowned investment avenues, the discrepancies become evident. For instance, the stock market, one of the most lucrative investment sectors, has its bull runs, but never in history has it showcased such exponential growth in a blink. Even the cryptocurrency realm, known for its volatility, has its moments of surges but still operates within a predictable frame of peaks and troughs.

- Industry Benchmarks: The benchmarks established by the investment industry have been carved out of years of data, analysis, and market behavior. These benchmarks serve as a compass for investors, guiding them on expected returns. The figures projected by Edu-pension not only challenge these benchmarks but also challenge the very foundations of investment wisdom. It’s crucial to note that high returns come with high risks. And in this case, the risks might just outweigh the potential benefits.

- Unrealistic Projections: The world of investment isn’t a casino, but Edu-pension’s promises resemble a gamble. Genuine investment strategies involve market research, understanding economic indicators, and often, patience. Returns of such magnitude in such short time frames indicate a model that’s not based on genuine market dynamics but rather on creating an illusion of profitability.

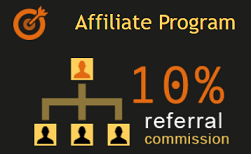

The Pyramid Scheme Tactic and Referral Lures

At the heart of Edu-pension’s operation appears to be a model reminiscent of classic pyramid schemes. Such schemes are predicated on a simple, yet unsustainable promise: exponential profits for early investors funded by the capital from new ones. This creates a vicious cycle, often culminating in massive losses for those at the pyramid’s base.

- The Mechanics of the Pyramid: The fundamental idea behind a pyramid scheme is that the initial promoters recruit new investors, who in turn, recruit more investors, and so on. As the pyramid grows, so does the promise of profits for those on top. However, as with all pyramid structures, the base needs to keep widening for the system to sustain. When the recruitment slows down, so does the flow of funds, leading to inevitable collapses and substantial losses for many.

- Referral Lures: To amplify their reach and pull more investors into their fold, Edu-pension dangles a carrot: a 10% referral commission for their affiliate program. This isn’t just an incentive; it’s a potent tool to ensure a consistent inflow of new investors, propelling the pyramid further. However, beyond the facade of this seemingly attractive offer lies a strategy to entice more individuals into a potentially risky venture.

- Unsustainability: History is replete with examples of pyramid schemes that started with much fanfare, only to crumble under their own weight. The model’s inherent flaw is its reliance on an ever-expanding base. Once the growth stagnates, the pyramid begins its descent into chaos, leaving a trail of financial devastation.

A Regulatory Red Flag

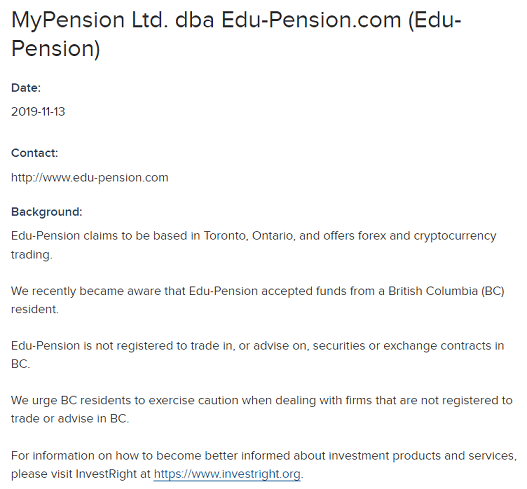

To further accentuate the dubious nature of Edu-pension, the British Columbia Securities Commission (BCSC) issued a stark warning against them.

In no uncertain terms, the BCSC clarified that Edu-pension is not authorized to trade in, or advise on, securities or exchange contracts in British Columbia. Such a direct warning from a reputable regulatory body is a significant red flag.

The Verdict from The Masses: Customer Feedback

The Voices on Trustpilot

In today’s digital age, the real barometer of a company’s credibility is often found in online reviews. Trustpilot, a platform renowned for its genuine customer feedback, paints a somber picture for Edu-pension. The overwhelming sentiment? Negative reviews, with many customers crying foul and alleging they’ve been scammed.

Conclusion

The allure of high returns is undeniably tempting, but it’s essential to differentiate between genuine opportunities and deceptive mirages. Edu-pension, with its unregulated status, questionable promises, and pyramid-esque model, emerges more as the latter.

When the path ahead seems paved with gold, it’s wise to tread carefully, examining each stone. Remember, all that glitters is not gold.

Got Scammed by Edu-pension?

If you have lost money with Edu-pension, stay calm. It has likely happened to many others, and it its important to learn from these experiences. Do not forget that even the most cautious investors can fall victim to online fraud.

The good news is that there is help available. The team at MyChargeBack – a specialist group dedicated to helping consumers recover funds lost online – can help you.

5 Simple Steps To Get A Chargeback From Edu-pension

Follow our straightforward guide to efficiently reclaim your lost funds from Edu-pension with minimal hassle.

- Complete the Form: Begin by completing the form above, providing necessary details about your case. This allows the team to understand your situation with Edu-pension and prepare for the consultation.

- Get A Free Consultation: Schedule a free consultation with MyChargeBack team of experts. During this consultation, they will assess your case and offer guidance on the best course of action to recover your lost funds from Edu-pension.

- In-Depth Case Analysis: As you proceed with MyChargeBack, their expert team conducts an in-depth analysis of your case, identifying the optimal chargeback strategy for fund recovery based on your unique circumstances.

- Recovery Process: Their team of specialists scrutinizes your case, collects evidence, and negotiates with the involved parties to expedite the recovery of your funds. MyChargeBack team will consistently communicate with you and your bank or card issuer during the chargeback process.

- Fee Payment: Upon successful recovery of your funds lost to Edu-pension, MyChargeBack charges a fee as a percentage of the reclaimed amount. If fund recovery is unsuccessful, no fees apply, except in exceptionally complex cases.

Through these five straightforward steps, MyChargeBack simplifies the fund recovery process, enabling you to reclaim your money from Edu-pension with minimal inconvenience.

FAQs

Why is it vital to ensure an investment company is regulated?

Regulatory bodies ensure that investment companies maintain transparency, adhere to financial guidelines, and safeguard investors against potential fraudulent activities.

Are the promised returns of 330% in 30 minutes or 1100% in 2 hours realistic?

Such returns are exceedingly rare in the realm of genuine investments. They’re not supported by established industry benchmarks and are often associated with high risks.

What are the inherent dangers of a pyramid scheme?

Pyramid schemes are inherently unstable. They rely on a consistent influx of new investments to pay older ones, making them unsustainable in the long run.

How significant is the BCSC’s warning against Edu-pension?

The BCSC is a respected regulatory authority. Its warning against Edu-pension underscores the potential risks and malpractices associated with the company.

Should online reviews influence investment decisions?

While online reviews shouldn’t be the sole determinant, consistent negative feedback from a vast pool of users is a strong indicator of underlying issues and should be taken into account.