Introduction

In the busy world of online forex trading, many brokers are trying to get your attention with different features and promises. SafeCaps is one of these brokers.

Before you think about investing your money with them, it’s very important to check if they are trustworthy and safe to use.

This detailed review will give you information about SafeCap, a broker that isn’t regulated and has been warned against by financial authorities.

SafeCaps Details

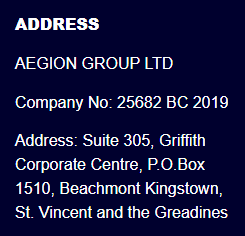

SafeCaps operates as an online trading broker and is a subsidiary of Aegion Group Ltd. The firm’s address is Suite 305, Griffith Corporate Centre, P.O. Box 1510, Beachmont Kingstown, St. Vincent and the Grenadines.

For support or inquiries, you can reach out to SafeCaps’ customer service team by phone at +35725263290, or by emailing them at support@safecaps.io, support@safecap.io, or compliance@safecap.io.

You can explore their official websites at safecaps.io and safecap.io.

Exercising due diligence and comprehensive research is crucial before engaging with any online trading broker, SafeCap included.

To help you make an educated decision, consider checking out our in-depth reviews of two other companies we have recently examined: Trade Smart Securities and Binance-AutoTrade.com.

Company Background and Regulatory Status

Location and Regulatory Concerns

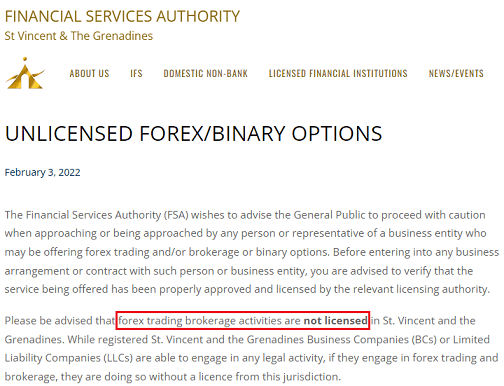

SafeCaps claims to be located in Saint Vincent and the Grenadines, a jurisdiction infamous for its lax regulatory environment and a haven for online forex scams.

According to the Financial Services Authority of St Vincent & the Grenadines (SVGFSA), ‘forex trading brokerage activities are not licensed in St. Vincent and the Grenadines.’ While business companies or LLCs registered in this jurisdiction can legally engage in any activity, those dealing in forex trading do so without a license from the SVGFSA.

Warnings from Financial Authorities

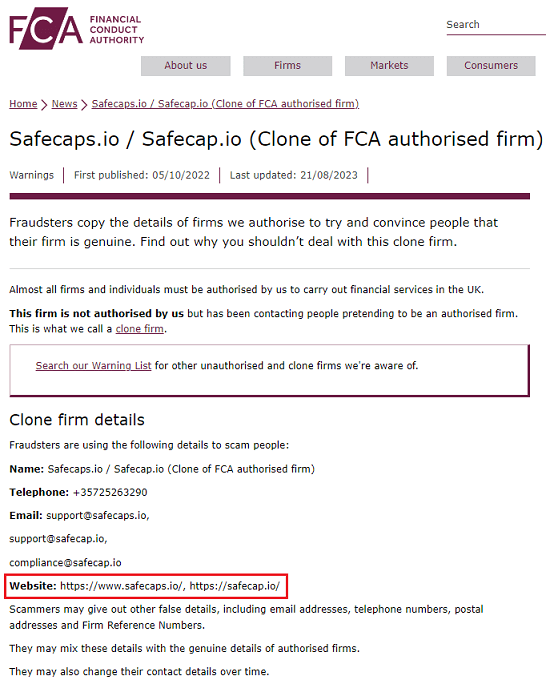

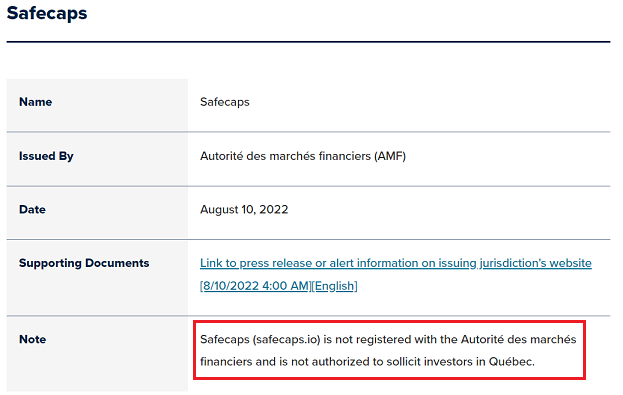

The Financial Conduct Authority (FCA) in the UK and L’Autorité des Marchés Financiers (AMF) in Quebec have both issued warnings against SafeCaps. These authorities have clearly stated that SafeCap may be providing financial services or products without their authorization.

The broker even went so far as to rebrand itself to SafeCap, dropping the ‘s’ and changing its domain name to escape these warnings.

Online Reputation

Customer Reviews and Feedback

Customer reviews can provide valuable insights into a company’s reputation. Websites like Trustpilot feature numerous reviews of SafeCaps, and a significant number of these are negative. Customers claim to have been scammed by the broker, shedding light on its dubious practices.

Use of AnyDesk Software

The use of remote desktop software like AnyDesk by SafeCaps raises several red flags and is a matter of considerable concern. AnyDesk allows another user to control your computer remotely, ostensibly to provide customer support or troubleshooting.

However, this same capability makes it an ideal tool for scammers, especially when used in environments with little to no oversight, such as unregulated forex trading platforms.

In numerous reported scam cases involving forex brokers, AnyDesk has been used to gain unauthorized access to users’ computers.

Once in, the scammers can do anything from manipulating the trading software to drain funds from your trading account. In worst-case scenarios, they can harvest personal and financial information like bank account details, credit card numbers, and passwords stored on your computer.

Trading Options and Account Types

Range of Tradable Assets

SafeCap.io offers a variety of assets for trading:

- Forex: A wide range of currency pairs.

- Stocks: Different global stocks to choose from.

- Cryptocurrency: Various popular cryptocurrencies like Bitcoin and Ethereum.

- Commodities: Includes gold, oil, and other natural resources.

- Indices: Numerous global indices available.

Types of Accounts

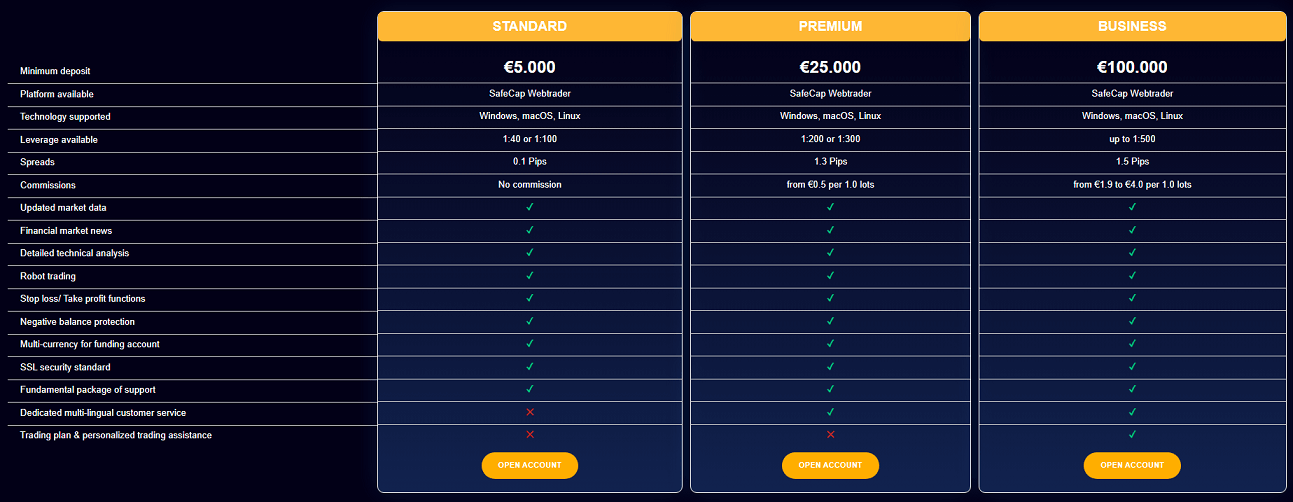

SafeCap.io provides three types of accounts:

- Standard: Minimum deposit €5,000 with leverage options of 1:40 or 1:100.

- Premium: Minimum deposit €25,000 with leverage options of 1:200 or 1:300.

- Business: Minimum deposit €100,000 with leverage up to 1:500.

Conclusion

While SafeCaps offers a variety of tradable assets and account types, the risk factors associated with this unregulated offshore broker are too numerous to ignore.

From the lack of regulatory oversight to severe warnings from reputable financial bodies, the platform poses significant risks to investors.

Its troubling online reputation and use of software known to be used by scammers add to these concerns. Investors should exercise extreme caution when considering SafeCap as a trading option.

Got Scammed by SafeCaps?

If you have lost money with SafeCaps, stay calm. It has likely happened to many others, and it its important to learn from these experiences. Do not forget that even the most cautious investors can fall victim to online fraud.

The good news is that there is help available. The team at MyChargeBack – a specialist group dedicated to helping consumers recover funds lost online – can help you.

5 Simple Steps To Get A Chargeback From SafeCaps

Follow our straightforward guide to efficiently reclaim your lost funds from SafeCaps with minimal hassle.

- Complete the Form: Begin by completing the form above, providing necessary details about your case. This allows the team to understand your situation with SafeCaps and prepare for the consultation.

- Get A Free Consultation: Schedule a free consultation with MyChargeBack team of experts. During this consultation, they will assess your case and offer guidance on the best course of action to recover your lost funds from SafeCaps.

- In-Depth Case Analysis: As you proceed with MyChargeBack, their expert team conducts an in-depth analysis of your case, identifying the optimal chargeback strategy for fund recovery based on your unique circumstances.

- Recovery Process: Their team of specialists scrutinizes your case, collects evidence, and negotiates with the involved parties to expedite the recovery of your funds. MyChargeBack team will consistently communicate with you and your bank or card issuer during the chargeback process.

- Fee Payment: Upon successful recovery of your funds lost to SafeCaps, MyChargeBack charges a fee as a percentage of the reclaimed amount. If fund recovery is unsuccessful, no fees apply, except in exceptionally complex cases.

Through these five straightforward steps, MyChargeBack simplifies the fund recovery process, enabling you to reclaim your money from SafeCaps with minimal inconvenience.

FAQs

Is SafeCaps a regulated broker?

No, SafeCaps is an unregulated offshore broker, and it has received warnings from financial authorities like the FCA and AMF.

Where is SafeCap located?

It claims to be located in Saint Vincent and the Grenadines, a jurisdiction known for not licensing forex trading activities.

What types of accounts does SafeCaps offer?

SafeCaps provides three types of accounts: Standard, Premium, and Business, with varying minimum deposits and leverage options.

Is it safe to use AnyDesk with SafeCap?

The use of AnyDesk software is a red flag, as it is commonly used by scammers to gain unauthorized access to your computer.

What do customer reviews say about SafeCaps?

Most customer reviews of SafeCaps on platforms like TrustPilot are negative, and people claim to have been scammed by the company.

Brandon Linton says:

Hello sir,

Did SafeCaps ask you to install any software on your computer as AnyDesk or TeamViewer ? if yes scammer can access your computer and get your bank access!

SafeCaps is blacklisted by the Financial Conduct Authority in England. Feel free to fill the form on the website to get help with Mychargeback.

COLLAS says:

J’ ai été contacté début Novembre par une personne du nom de ARMAND MICHEL, disant travailler pour BINANCE.

Il a réussi à m’ inspirer Confiance, en m’ expliquant qu’ il faisait des opération en Crypto, et qu’ il était capable de très bons résultats pour la fin de l’ année.

j’ ai commencé à mettre 250€ et en ai rajouté jusqu’ à hauteur de +11000€

Mardi 27/12, le solde de mon compte était de 39500€, et il me proposait de retirer 38000€.

La demande ne pouvant réussir à être exécuter.

Il m’ a demandé de regarder mon espace bancaire, et voir si quelque chose pouvait bloquer.

Et quelques instant plus tard, je me suis rendu compte que pendant que nous nous parlions que tous mes comptes venaient d’ être vidés pour créditer l’ un de mes compte duquel, 2 virements de 38000€ plus un de 21600€, ont été fait sur la Banking Circle

IBAN: LU734080000096394310

Aujourd’ hui, je n’ ai plus d’ argent sur aucun de mes comptes y compris celui de mon entreprise qui ne peut plus fonctionner.,

Brandon Linton says:

Hello,

SafeCaps is blacklisted by the regulator in the United Kingdom (FCA), Feel free to fill the form on the website in order to get help with Mychargeback to build a chargeback case with your bank.

sarah.mei.pierre says:

J’ai besoin de mon argent pour payer mes entreprises artisanales

Cette sarah.mei.pierre@safecaps.io

Ma ruiné

J’ai besoin d’aide très vite

Très Urgent